Condo Insurance in and around Napoleon

Condo unitowners of Napoleon, State Farm has you covered.

Protect your condo the smart way

Would you like to create a personalized condo quote?

Calling All Condo Unitowners!

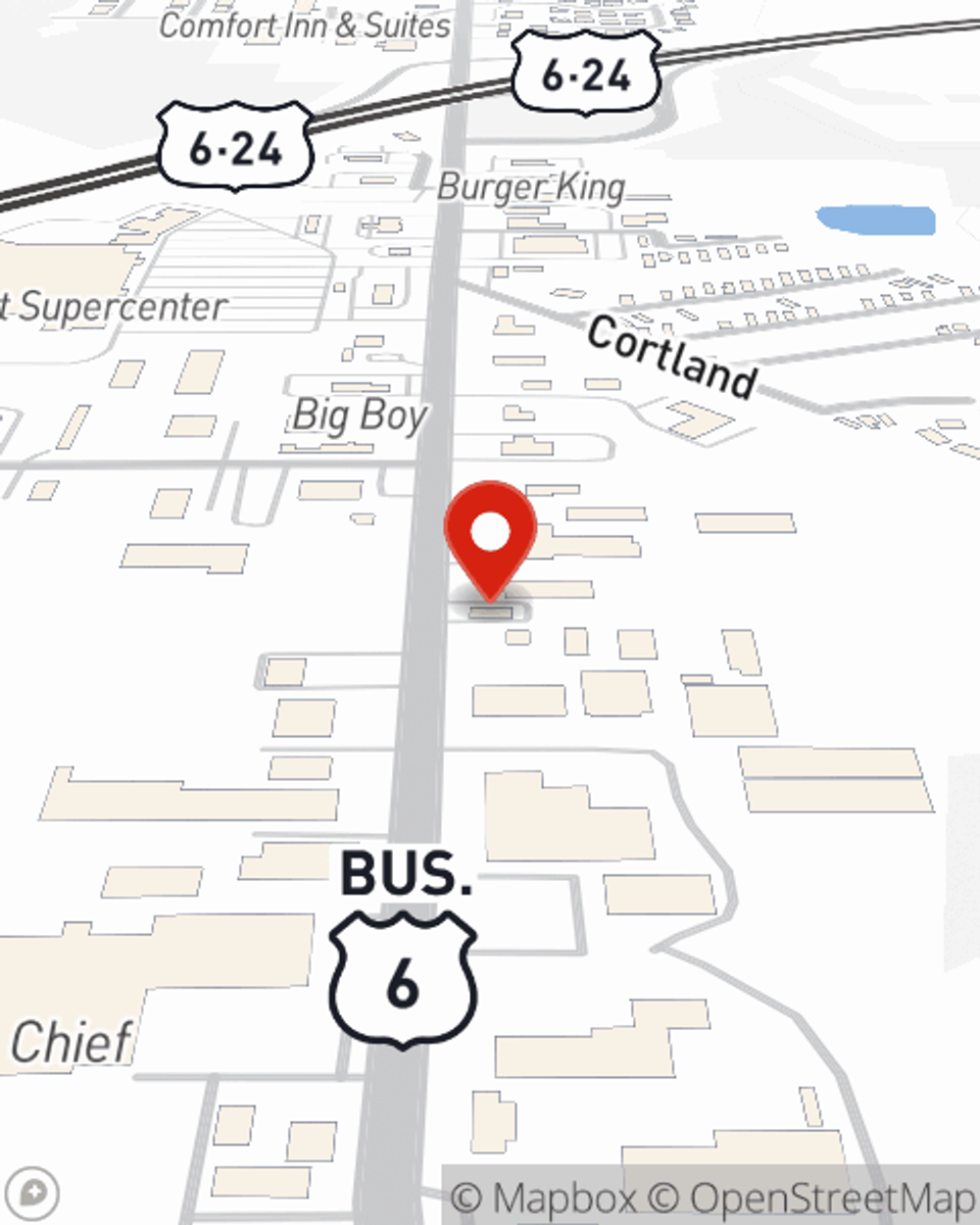

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Napoleon. Sorting through providers and savings options is a lot to deal with. But if you want great priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Napoleon enjoy unbelievable value and straightforward service by working with State Farm Agent Darlene Steiner. That’s because Darlene Steiner can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as appliances, sound equipment, collectibles, furnishings, and more!

Condo unitowners of Napoleon, State Farm has you covered.

Protect your condo the smart way

Put Those Worries To Rest

When an ice storm, fire or a windstorm cause unexpected damage to your condo or someone gets hurt in your home, having the right coverage is important. That's why State Farm offers such excellent condo unitowners insurance.

As a value-driven provider of condo unitowners insurance in Napoleon, OH, State Farm strives to keep your belongings protected. Call State Farm agent Darlene Steiner today and see how you can save.

Have More Questions About Condo Unitowners Insurance?

Call Darlene at (419) 592-0826 or visit our FAQ page.

Simple Insights®

How do I get rid of bed bugs?

How do I get rid of bed bugs?

Learn how to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What are the different types of insurance?

What are the different types of insurance?

You've probably heard of car insurance, homeowners insurance and life insurance. Find out what's covered under these and other types of policies.

Darlene Steiner

State Farm® Insurance AgentSimple Insights®

How do I get rid of bed bugs?

How do I get rid of bed bugs?

Learn how to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What are the different types of insurance?

What are the different types of insurance?

You've probably heard of car insurance, homeowners insurance and life insurance. Find out what's covered under these and other types of policies.